Follow the steps below to update your state W4 in the Employee Self Service section of myFSU.

1. Login to myFSU and click the HR icon at the top-left of the screen.

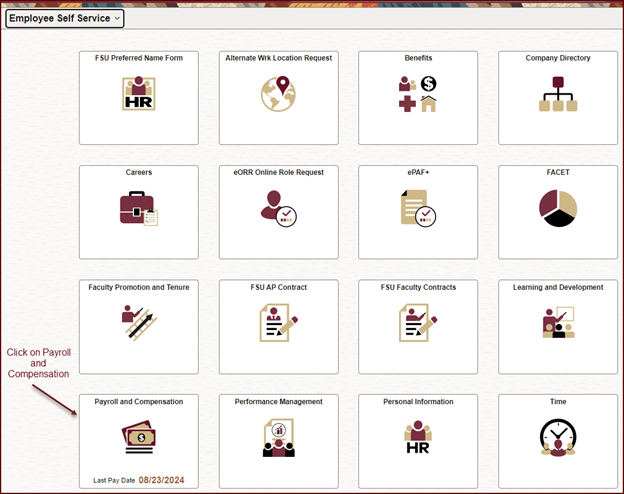

2. Select the Payroll and Compensation tile on the Employee Self Service page.

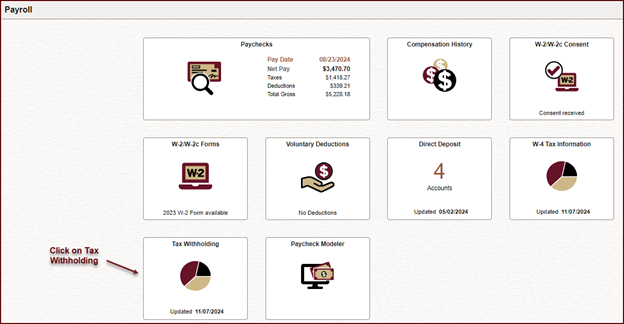

3. Click on the Tax Withholding tile.

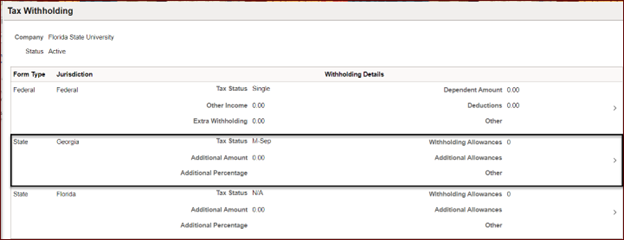

4. Click on the arrowhead to the right of the Form Type and Jurisdiction. The page will show current settings of both your Federal and State W4. To update your State W4, click within the section.

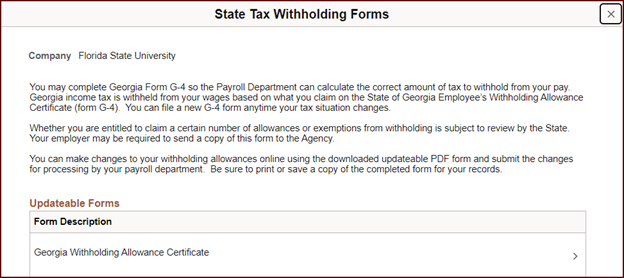

5. The State Tax Withholding Form (W4) will appear. Under the Updateable Forms section, click on the withholding certificate.

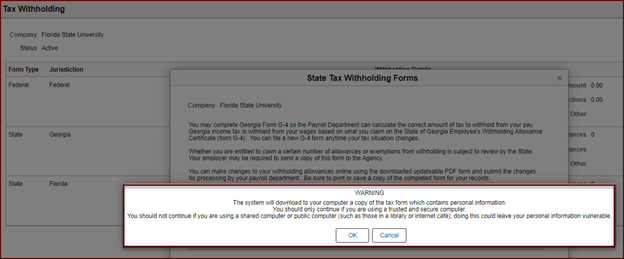

6. You will receive a warning that the system will download a copy of the tax form to your computer which contains personal information. Click OK.

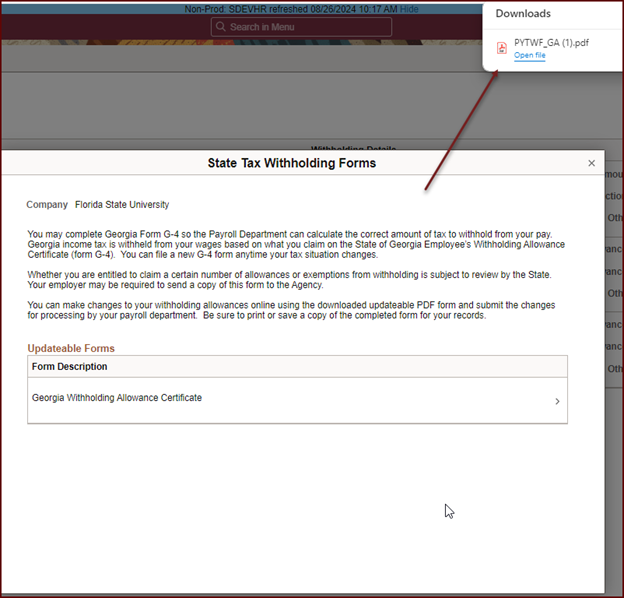

7. Click on the arrow to the right and the form will appear in the Downloads section of your computer.

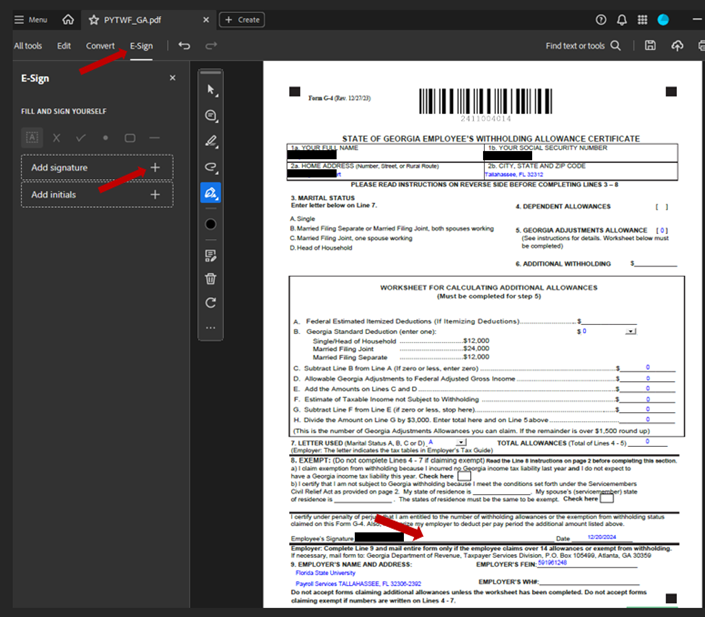

8. Open PYTWF_GA.pdf form from your computer's Downloads section.

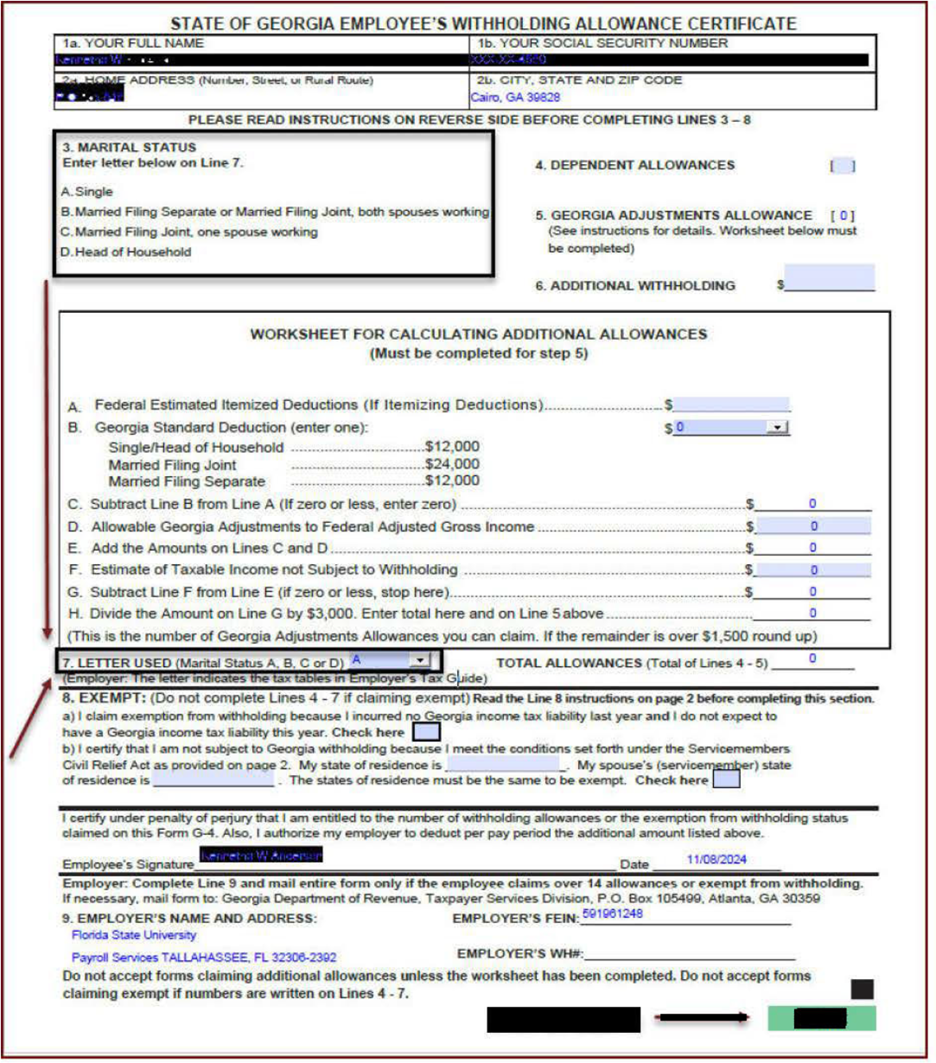

9. Fill out the form and save the file. For Marital Status #7, see the image below.

10. Sign the form. On the left pane, click on E-Sign to create a signature, if not already created. Place signature on Employee’s Signature line and save.

11. Submit the completed and signed State Withholding form to Payroll Services electronically via FSU NiFTy (nifty.fsu.edu) to our email address CTL-Payroll-Tax@admin.fsu.edu. Unsigned forms cannot be processed.